This post belong to the Beyond Mathematical Odds series. Advise you to read this post, and this one, to have a better context on this one, because what I wrote, literally came to be.

First, I think I may do a bunch of analysis, and once in a while an opinion. Gut tells me it’s the best approach, always listen to your gut, people !

This is part of the Beyond Mathematical Odds series, which you might want to read for a full scope picture, and my last more opinionated piece would be a good read too. Why ? Because what I wrote is already coming to pass.

Rationing is coming to Europe.

Gas in Germany, flour in Greece, sunflower oil in Spain: European countries take steps towards rationing as the war in Ukraine adds to the global supply crunch

As a result, the prices of everything from wheat to oil have soared, leading to multi-decade high inflation rates in places like Germany and Spain. The supply crunch in Europe is now so bad it’s causing governments to begin laying the groundwork for rationing, with some stores already limiting supplies.

Fuel rationing meme has already inserted in the mainstream media, therefore into the mimetic unconscious. This will come to pass in quite a few number of countries, because nobody knows what the hell they can do. As an actual example.

French Grid Manager Asks Users to Reduce Consumption on Monday

France’s electricity grid manager asked businesses and households to cut consumption as a cold snap pushes demand higher at a time time when around half of the country’s nuclear reactors are offline.

I also kept an eye, and mentioned Sri Lanka a few times.

As I wrote this piece, this happened.

Sri Lanka Cabinet Offers to Resign as Economic Unrest Builds

Growing anger against policies amid soaring costs, FX crisis

President had imposed emergency rule, throttled social media

Why do I mention Sri Lanka in a few posts, not merely to make you notice a pattern, but for something far more important. Because the cascade failure dynamics there, will also play elsewhere, mostly in poorer countries first. They have been experiencing massive civil unrest.

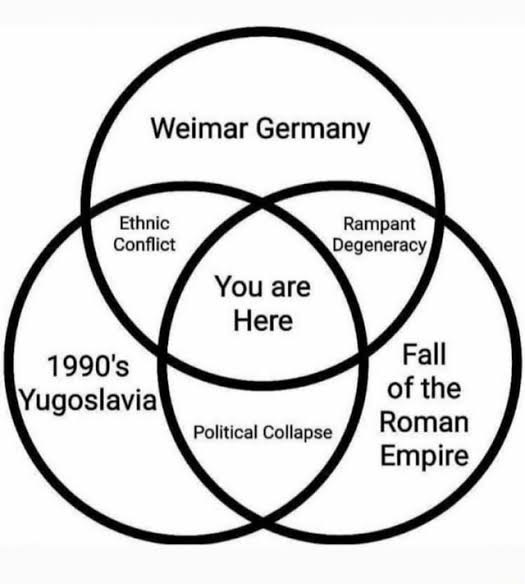

What is happening in Sri Lanka right now will come to pass in other countries, as I said multiple times, first in poorer countries, then in “richer” ones, and perhaps not, perhaps localized unrest in different countries, regardless of global economic status. The reader should pay attention to governmental response, and specially, popular behavior. It is historically the same everywhere. Leading us to the following news.

As I also wrote about China in the last post, here the increasing signs from Shanghai logistical problems. You can read the entire thread here.

From that thread, and as I mentioned, China never executed a lockdown with such restrictive measures, specially for truckers.

As I said previously, China is closing in on a critical moment for its government. No government in China stood for long after people started starving, and the Chinese have not starved as a whole for a while, and they won’t take it easily.

After a couple of weeks pushing bs, reality comes knocking.

The Price for Europe to Wean Off Russian Gas Keeps Going Up

Steel, copper and aluminum setting records as supplies tighten

Bold plans for wind, solar and pipelines get more expensive

Yet prices for the necessary materials keep heading in one direction. Steel, copper and aluminum each touched records in the past 12 months, and the Bloomberg Commodity Spot Index jumped 46% during the same period. The spikes threaten to slow such undertakings as the European Union’s blueprint to almost triple wind and solar capacity this decade -- a colossal investment that could require about 52 million tons of steel alone.

Russia and Ukraine are among the biggest exporters of steel slabs used in building turbines and gas pipelines. While alternative sources are possible, costs for those are 50% higher than normal, according to Rysted Energy AS.

Compounding the problem is China’s decision to lock down its steelmaking hub of Tangshan in an effort to control a Covid-19 outbreak.

Copper is another vital ingredient, with high conductivity that’s ideal for internal wiring and external cables. Europe requires about 7.7 million tons to meet its 2030 target, and this year’s rally adds about $7.6 billion to the price tag, according to Bank of America Corp.

Then there’s the aluminum needed for solar panels, turbines and the grids they connect with. Europe has a critical shortage because production dropped after soaring power costs reduced smelting profits.

Russia is the largest producer outside China, with its refined aluminum accounting for about 5% of global production.

Absolutely nothing new if you have been reading me for at least the last 8 to 10 weeks. While the raw materials can be sourced elsewhere with investment, and somewhat long term deals, the fact is in the end China ends up winning. I have nothing more to add, because I wrote somewhat extensively about it. Things are playing out as reality demands it.

This was the best quote from the paper.

“Everyone is talking about accelerating the energy transition, and everyone will need the same materials,” said Julian Kettle, senior vice president for metals and mining at Wood Mackenzie Ltd.

Raised this question for some experts, but went on ignored. Which fits quite well into this, a point I raised in my opinion piece.

Biden’s Energy Marshall Plan for Europe Is No Quick Fix

Facilities to export and receive liquefied natural gas cost billions of dollars and take years to build.

Even operating at full tilt, the seven LNG export terminals stateside would meet only about a third of Europe’s daily gas demand. The facilities cost billions of dollars and take years to build, and a lack of financing has created a bottleneck: Roughly a dozen proposed terminals authorized by U.S. regulators over the past several years haven’t been built because developers are still trying to line up funds. And Europe doesn’t have enough import facilities to absorb a significant increase in U.S. tanker traffic.

Would like to leave a note that most of the fault here lies, besides the US government, with Black Rock/Vanguard, and impact funds. They spearheaded the drying of investments in areas the world needed, out of pride, and misguided forecasting (They suck a lot at it in times of higher uncertainty)

● Construction costs and financing

Venture Global LNG Inc.’s Calcasieu Pass export terminal, under construction in Louisiana, will cost about $5.8 billion—and it’s one of the less expensive projects. Even a single new LNG‑producing unit at an existing facility takes about two and a half years to complete, according to Goldman Sachs.

Similar with LNG carriers, the terminals are also expensive, and take years to build. There is no feasible way for America to supply all the “promised” LNG before 2025 at best, if no further disruption grace our beautiful world. The export of LNG at the quantities the EU needs will also impact domestic prices in the US, and some already blame the current 45% increase in the bills on that. It is not, however, solely that, but it does play a part.

Europe CAN NOT sustain the current… whatever they are doing. Why ? Because, again, what I mentioned many times, came to pass.

And this isn’t even the worst news. Germany, who is much more dependent on Russia for fuel, and energy, is facing this.

German retailer Aldi Nord to raise prices by 20-50% on Monday

Meat, sausage products, butter to be more expensive amid rising production, energy costs due to Russia-Ukraine war, says spokesman

German retailer Aldi Nord will raise its prices by an average of 20-50% due to an increase in production costs, local media reported on Sunday.

From Monday onwards, meat, sausage products, and butter will be "significantly more expensive," a company spokesman told German press agency DPA, adding that the price hikes in various products were necessary due to the rise in manufacturing costs.

"Since the beginning of the war in Ukraine, we're witnessing jumps in purchase prices that we have not experienced in this way before," said spokesman Florian Scholbeck.

That isn’t merely inflation. This is hyperinflation at play, with cascade failure dynamics at play, and this will lead Germany into a recession, and make the whole country walks towards actual poverty. And you have insane EU politicians saying they should outright ban all imports from Russia.

Cost of Living Rises in India as Companies Pass on Higher Prices

Inflation spike risks denting disposable incomes, consumption

RBI to decide on rates April 8 amid above-target inflation

Indian manufacturers are running out of capacity to absorb rising input costs, with an increasing number passing it along to consumers in an economy already grappling with Asia’s third-fastest inflation and an uneven recovery.

Companies from the Indian units of Unilever Plc and Suzuki Motor Corp. to homegrown JSW Steel Ltd. are raising prices in response to the global supply squeeze made worse by the surge in energy costs following Russia’s invasion of Ukraine. Higher retail fuel prices are also threatening to hurt demand just as the economy returned to its first full-year of growth after the pandemic-induced 6.6% contraction in the fiscal year ended March 2021

A couple weeks ago, both the rail, and trucking sectors warned the government they had reached full logistical capacity, among all the other shocks in the system, from the rest of the planet. Now India faces the same fate as other countries, but thankfully their leadership think about the lives, and stability of the people, and have bought oil from Russia at a discount.

Still hard choices ahead, and seems recovery is threatened everywhere, but I do think they are positioned to be better off than their European counterparts.

Tunisia doubles phosphate output in first quarter, targets 5.5 million tonnes in 2022

The North Africa country seeks to regain its position as a leading exporter to take advantage of sharp increase in fertilizer prices due to the war in Ukraine.

Tunisia was once one of the world’s largest producers of phosphate minerals, which are used to make fertilisers, but its market share fell after 2011 revolution.

This news is here part because it is a good news, since the world is in dire need of phosphatebecause of China, and Russia, and part because of the second paragraph that made me scratch my head for half an hour…

Yet here we are, this will raise feed costs to other animals too…

Farmers turn to soybeans over corn as fertilizer prices spike

For just the third time in recorded history, farmers will be planting more soybeans than corn as they grapple with the rising cost of fertilizer — a cost that will almost certainly be passed on to consumers.

Prices for some types of fertilizer cost a record $1,520 per ton, an increase of 127% this year. Corn is up 4%, at nearly $7.67 per bushel. As a result, 4 million fewer acres of corn will be planted, while soybean crops will increase by the same amount, MarketWatch reported.

Soybeans put nitrogen back into the ground rather than extract it, so they only need a small amount of fertilizer when compared to corn. Previously, the average farmer used 255 pounds of fertilizer for corn, compared to 65 pounds for soybeans, Bloomberg reported.

But fertilizer is just one part of the equation when it comes to rising food prices. Farmers have also endured rising costs for livestock feed, fuel, machine parts, and herbicide.

To make matters worse the Midwest is experiencing drought-like conditions that yield poor crops.

“It feels like going down the hill in a truck and picking up speed but not being sure if you can make that corner at the bottom,” Iowa farmer John Gilbert said of the numerous calamities that growers are enduring

This is the second time I said this, but defaults are a historical norm over 750 years of economical data. All the current strains in the system are positioning the world economy for a once in a millennium “correction”.

Software glitch halts trains across the Netherlands

Trains operated by the national rail network were halted across the Netherlands Sunday by what the operator called a technical problem.

Erik Kroeze, a spokesman for railway operator NS, said the problem was in a planning software system. He said there were no indications it was caused by a cyberattack

Last week, Italy suffered a cyberattack. As usual, companies will say it is a technical problem, or a bug, and when nobody is paying attention, they will confirm it was a hack.

And this almost 2 years old, completely avoidable disaster, keeps spreading, and getting out of hand. Another concerning trend I am witnessing is the one where, at the same, there is a push against free-range chickens. Both in the US, and Europe.

And as I previously forecasted, and people said I was wrong, because that would never happen. I expect the following to happen elsewhere too at some level.

Egg shortage warning as industry calls for immediate price rises

Consumers could see egg shortages within “a matter of weeks” unless retailers raise prices to cover rapidly increasing production costs, poultry industry leaders have warned.

The British Egg Industry Council (BEIC) said customers were likely to see shortages without urgent action, while the British Free Range Egg Producers Association (BFREPA) said shoppers needed to be paying 40p extra per dozen eggs to avert a catastrophe in the sector.

BEIC predicts 10-15% of egg farmers could leave the industry, with producers losing money on every egg their hens produce

As a last thing to note. Language, and memes are very good forecasting tools…

You can use Ko-Fi to buy me a coffee.

If you enjoy independent, interdisciplinary analysis, based on evidence and not fearmongering, consider becoming a free or paying subscriber, support is very much appreciated. Sharing also helps me tremendously. Deep appreciation for all the supporters.

Good stuff.

Re: "What is happening in Sri Lanka right now will come to pass in other countries, as I said multiple times, first in poorer countries, then in “richer” ones."

RUS has stated it won't deliver gas to UK.

Try imagining the speed of chaos in un-resilient sociteties.

- China Covid situation & reaction remains a mistery for me.

It’s awful to be right on the money at times. 😬 I appreciate your forecasting skills none the less. Trying to prepare as best we can, but ultimately I fear most of us are going to pay a heavy price for the calculated incompetence of our “leaders”.