This post will have the normal analysis, but I will also point out that governments have been laying the groundwork for the current, and coming mess we see ourselves in.

First a very impactful one, for both the US, and Canada itself, given the current circumstance of growing global food insecurity. A tweet making the rounds about the proposal of Canada to cut nitrous oxide by 30%.

Details regarding the federal government’s proposed 30 per cent emission reduction target for fertilizer use are yet to be released, as Canadian producers and agriculture stakeholders raise concerns about the impact the reduction could have on yield.

Though voluntary, the total, or absolute reduction of emissions produced by fertilizer use has become a concern for many in the agriculture industry.

“They’ve set it as a voluntary target but as industry, and as the agricultural sector, we take it very seriously when the government says, ‘We expect you to do this,’ because we know if we’re not achieving the expectations in the time frame, it’s quite possible the government decides to regulate,” Karen Proud, president and CEO of Fertilizer Canada, told the News.

Per the piece of news itself, it is voluntary for now, but the groundwork for this move has been present, literally everywhere. The EU plans to curb fertilizers emission within the next 10 years too, same within the US government.

Of course, this doesn’t just happen, academia has been pushing this for a couple of decade, like this insane paper, arguing using a specific amount of fertilizer, and getting 80% of the yield. In a decade where food inflation will be historic. MIT, Harvard, every single one of them refer to the same flawed models and the “current science”.

My point in sharing this is, that people should start opposing ESG, and climate bullshit now. It is already late for a complete opposition without pain, and some loss of quality of life for a short while. But better late than never.

I do agree, at some level, that change is necessary, but not at this point, where the cost will be unfathomable.

Demand destruction is already happening, but the good news is, that some of the ammonia producers in Europe are coming back online, and this might ease the prices a little.

TESCO has joined supermarkets like Iceland and Morrisons in rationing a staple household item

The seed oil industry finds itself in an uproar, for multiple reasons. Per my post talking about some German markets rationing flour and seed oil, because of the constraints of the conflict between Russia and Ukraine, both countries make most of the world's sunflower oil. Morrisons, Waitrose, and Iceland were quick to impose their own buying limits on sunflower oil earlier in the week too.

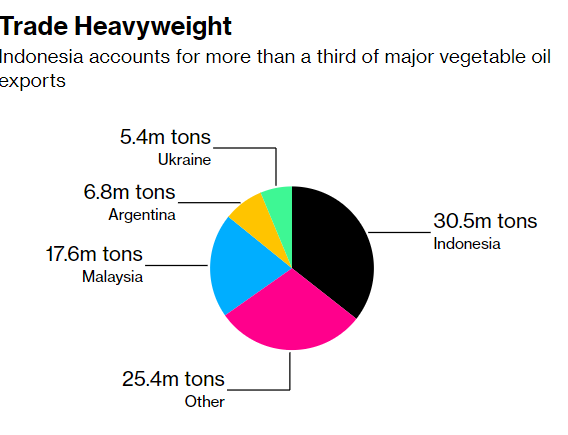

The second reason is, Indonesia. It accounts for a third of the total edible oil exports in the world.

Indonesia’s supply of edible oil to the world is “impossible to replace,” said Carlos Mera, head of agricultural commodity markets research at Rabobank. “It’s definitely a big blow.”

As I said once, Resource Nationalism will be usual when internal stability is threatened by the market or global forces. Funny, I first mentioned the term because of Indonesia, and here we are again, Indonesia rocking the world once more.

Kosovo, Serbia, and North Macedonia banned the export of wheat, corn, flour, cooking oil, salt, and sugar. Egypt banned some staples.

including fava beans, lentils, pasta, wheat and flour of all kinds, edible oils of all kinds, ferik (a type of green durum wheat) and corn, according to an official statement published on the Facebook page of the Egyptian cabinet.

The local shortage of edible oil has roiled the country, leading to street protests over high food prices and the detention of a trade official in a corruption case. The government has rolled out cash subsidies and deployed police surveillance to safeguard nationwide distribution to temper prices and ensure ample supply.

Per numerous posts. Also, the closest substitute to palm oil is soybean oil.

It’s Getting Too Expensive to Export Soybeans From Top Grower Brazil

Road freight costs are higher than expected, Cargill says

Brazil soybean acres unlikely to shrink on fertilizer shortage

It’s getting very expensive to export soybeans from Brazil, the world’s top supplier.

That’s according to Cargill Inc., one of the biggest global shippers of the oilseed. Diesel price hikes and worsening road conditions have led to expensive freight rates. The cost to export soybeans this season has exceeded Cargill’s estimates for freight rates by at least 25%, slashing margins, according to Paulo Sousa, who heads Cargill’s operations in the South American nation.

Brazilian logistics is inefficient, the roads are terrible, poorly maintained creating the perfect condition for expensive, slow, chaotic at times freight. It would be in the interest of other nations to invest in the infrastructure and strong-arm the country to fix itself. Relying on something that is often unreliable will lead to poor outcomes, as you can clearly see everywhere these days. Used to be just here though. Fuel costs, and bad roads are not the only issue of the moment.

Corn Prices Rise as Prospects Weaken for Brazil, US Crops

In the US, cool and wet weather across the Midwest has delayed early corn planting. Gro’s Climate Risk Navigator application, weighted to US corn growing areas, shows the coldest temperatures in at least 20 years. US corn planting is just 4% complete this week, versus a five-year average of 6%.

In Brazil, favorable early conditions for the second corn crop, or safrinha, are giving way to dry weather just ahead of the crop’s critical reproduction and grain-fill growing period, raising the prospect of another La Niña-diminished harvest in June and July. No significant rainfall is forecast for Brazil’s already parched central and southern states for the remainder of the rainy season, which ends in early May.

Corn stocks in the US, the largest corn exporter, are the second tightest in eight years. Amid continued uncertainty surrounding exports from Ukraine, the No. 3 corn exporter, and crop prospects in North and South America, Gro predicts an even tighter corn balance sheet for 2022/23.

This one is merely me confirming my previous analysis, that, by the end of 2022, we will see a measurable total lower yield of grains, both because of fertilizers, and mostly because of the insane weather. Usually, at this time here, it would be already cold, cold enough you gotta use thick clothing inside your house. I spent most of the day with a fan blowing into my face.

April has ended with a historically high temperature. That is why it is affecting planting, therefore the yield down the line so much. And the summer as very cold…

UK ‘sleepwalking’ towards food shortages, farmers warn

Rising costs of fuel, fertiliser and feed are impacting on farmers

Farmers have warned the UK is “sleepwalking into food shortages” because of the rising costs of fuel, fertiliser and feed.

British farms are reducing production to deal with the increased prices, according to reports.

No further commentary is necessary. Besides, once again stating, the government is laying the groundwork for making the food shortages, worse. The example below is one, of many.

To further make my point, there is now a ship fuel shortage in the Northwest region of Europe, for a few reasons, higher demand, the conflict in Ukraine, but very importantly, an environmental rule. When you start looking into the pressure point that intensified problems, you often find these types of regulations inside.

A recent weird trend I have been starting to keep up with is the “explosions”, and “clashes” near important oil storage. Lybia just had one at the western port of Zawiya have damaged several storage tanks, Russia too, and Nigeria (it was an illegal refinery, but, interesting nonetheless). This leads us to the next point.

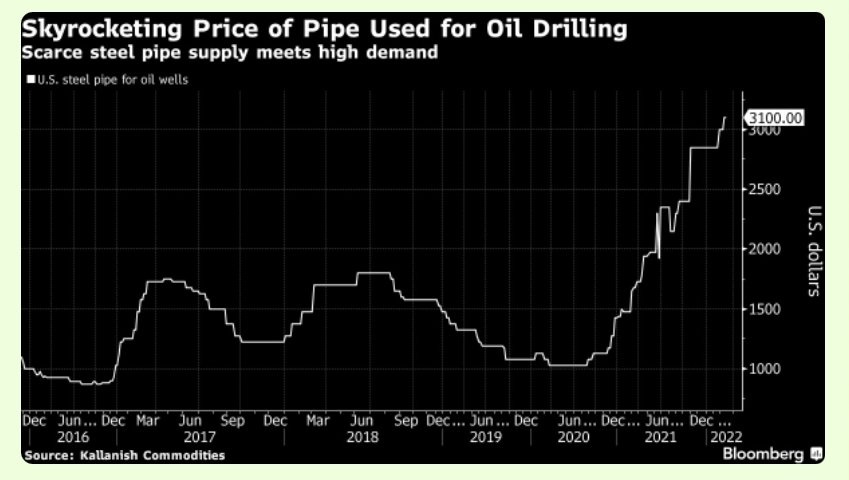

There is not an extensive shortage of steel pipes used for oil drilling in the US, which makes… well… drilling not only expensive, but untenable because it is not a question of cost, but inelastic demand, without raw material, you can’t quite produce the product. I covered the steel shortage extensively here, and on my Twitter, and bear repeating, if you need steel for a project, or anything else, you find a reliable source now.

This is a long-term trend that kept getting worse by unfolding events. Lockdowns from 2020, mandates, costs, disruptions, you named it.

Alas, I finish this post with actual good news.

Graphic chip price drop raises questions on whether end of shortage is in sight

A sharp drop in graphic chip prices could presage an unexpectedly quick ending to a global chip crunch that has crippled manufacturing from smartphones to cars, and the issue will be a central one for companies reporting results this week.

There is a debate over whether the lower prices will spread throughout the chip sector.

Softening demand from PC and smartphone markets is also resulting in price drops of other chips such as leading edge processors like CPUs and some memory chips, according to Summit Insights Group analyst Kinngai Chan, who expects the supply of some other chips made on older machines to face over-capacity in the second half of this year.

“Between all the fab investments and then all the bullishness that the shortage wasn't going to end until 2023, 2024, we said we could see a glut coming,” that extends beyond graphics chips, said TechInsights’ Dan Hutcheson, who has been following chip supply and demand for over 40 years.

Another reason for the decline in price is inflation, which will affect the consumption of expensive items. At least now you will be able to upgrade your PC with somewhat better prices. As long as Mother Nature doesn’t decide to just disrupt the entire market.

You can buy me a coffee whenever you feel like it.

Deep appreciation for all the supporters!

Also, do the readers want quick posts sometimes ? I try not to flood your inboxes with e-mails too much, and sometimes I get the feeling I write too much.

I do like a quick post now and then. Like the Pfizer investor letter. It WAS too delicious to not put it out there quickly.